Altman Z Score for Private Companies

Z-SCORE BETWEEN 27 and 299 - On Alert. Model A Z-Score 0717X1 0847X2 3107X3 0420X4 0998X5 3.

This indicated that 50 of the firms should have had lower.

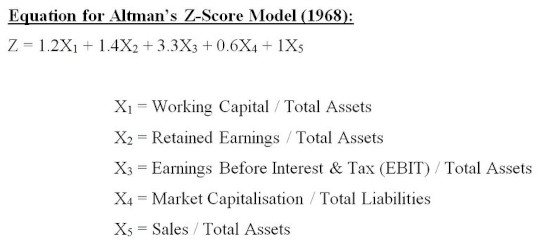

. Altman calculated that the median Altman Z-score of companies in 2007 was 181. So they are both Public and Private Non Manufacturer companies. Altman Z-Score Formula Altman Z-Score 12 X1 14.

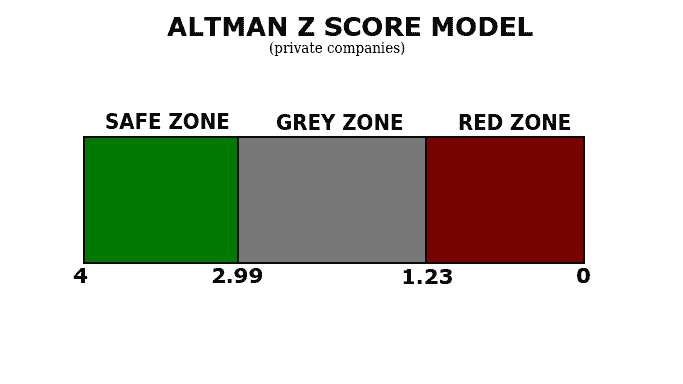

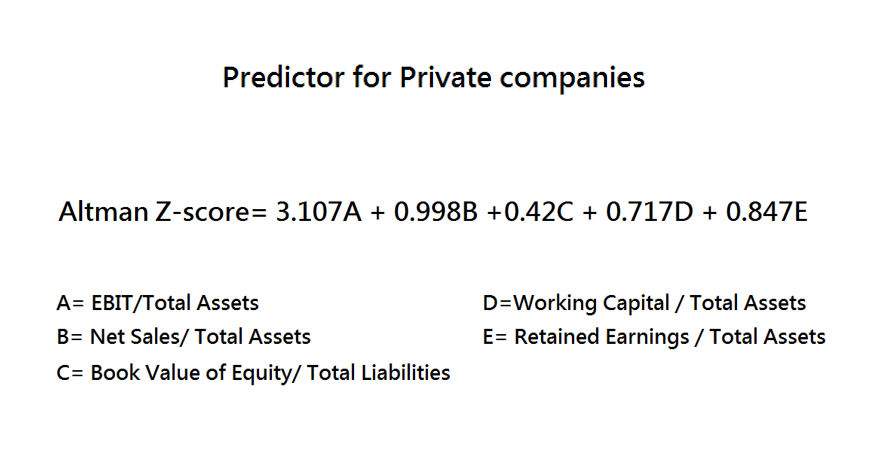

Z 0717 x A 0847 x B 3107 x C 0420 x D 0998 x E In this model if the Z value is greater than 299 the firm is said to be in the safe zone and has a negligible probability of filing bankruptcy. The private company version weights the variables differently and uses book value of equity in place of market capitalization. In depth view into FRAGDT0 Altman Z-Score explanation calculation historical data and more.

Z-SCORE BETWEEN 123 and 29 - On Alert. The Altman Z-Score model for a private company is. Altman relates the 3rd formula to Non Manufacturer companies.

Hi the 3rd formula is related to Private Service Companies. To calculate Z-score using Altman Z-Score Calculator the user has to input the accurate figure of the following data. This is the grey zone and one should exercise Caution.

Z-SCORE ABOVE 30 -The company is safe based on these financial figures only. These companies credit ratings were equivalent to a B. This model substitutes the book values of equity for the Market value in X4 compared to original model.

The Altman Z-Score model and analysis have proven to be an accurate measure for the susceptibility of businesses to going bankrupt. On the other hand private companies have a high chance of going bankrupt if the Z-Score is below 123. The actual Altman Z Score formula for this model for determining the probability for a firm to close bankruptcy is.

12 x Working Capital Total Assets 14 x Retained Earnings Total Assets 33 x Earnings Before Interest and Taxes Total Assets 06 x Market Value of Equity Total Liabilities 0999 x Net Sales Total Assets Altman Z-Score. Z-Score for Private Companies In 2002 Altman advocated a revised Z-Score formula for private companies. Z-SCORE BETWEEN 18 and 27 - Good chances of the company going bankrupt within 2 years of operations from the date of financial figures given.

The Altman Z-Score was published in 1968 by Edward Altman and measures a companys financial heatlth. For Model 2 the sound Z-Score for private companies is above 29 indicating a low bankruptcy risk. Below 18 suggests a high likelihood of bankruptcy.

Z score x13107 x20998 x30420 x40717 x50847 x1 EBITTotal Assets x2 Net salesTotal Assets. Altman Z-Score Private Firms A x 3107 B x 0998 C x 0420 D x 0717 E x 0847 The Interpretation of Z Score. The original z-score formula intended for public manufacturing companies is shown below.

This zone is an area where one should exercise caution. For calculation use our Altman Z- Score Calculator Z- Score for Private Companies The financial ratios and their weights vary a bit to predict bankruptcy in private companies. Z-Score 0717X1 0847X2 3107X3 0420X4 0998X5.

Original Public Firms Altman Z-Score formula. Altman then examined several common financial ratios based on data retrieved from annual financial reports. The formula for private companies is.

For example a Z-Score above 30 indicates financial soundness. He chose 66 publicly-traded manufacturing companies half of which had declared bankruptcy and half of which had not. Z-SCORE ABOVE 29 - The company is deemed Safe based on the given financial figures only.

The Altman Z-Score Calculator calculates the Z-score of different types of companies that is public private or non-manufacturing concerns. Sekur Private Data Altman Z-Score as of today August 20 2022 is 16517. The Interpretation of Z Score.

Model A Z-Score for private manufacturing companies. Working capital Retained earnings EBIT Earnings before Interest Tax.

No comments for "Altman Z Score for Private Companies"

Post a Comment